Fintech App Development: Step by Step Guide for 2024

India has shown a fantabulous percentage of acceptance in Fintech applications. 87% of consumers have adopted fintech products in India. Globally, India beats other countries by 23%.

India is a country with the highest population in the world. During the time of distress and covid, we had a need and people came with quick solutions. Consumers wanted easy money management as well as easy payment options. And this brought in the development of Fintech apps.

Let us read more about Fintech app development and how to make one.

What is a Fintech App?

A fintech app, short for financial technology application, is a software program that provides financial services and solutions through digital platforms, typically accessible on smartphones, tablets, or computers.

These applications leverage technology to streamline, enhance, and modernise various aspects of financial services, making them more convenient, efficient, and accessible to users.

Why is Financial App Development Important?

- Mobile Banking: Fintech apps enable users to manage their bank accounts, check balances, transfer funds, pay bills, and perform various banking tasks conveniently from their mobile devices.

- Payments and Transfers: They facilitate digital transactions, allowing users to make payments, transfer money domestically and internationally, and conduct peer-to-peer (P2P) transfers.

- Investment and Wealth Management: Fintech apps offer platforms for users to invest in stocks, bonds, mutual funds, and other financial instruments. Some apps also provide robo-advisory services to assist with portfolio management.

- Peer-to-Peer Lending: Fintech lending platforms connect borrowers with lenders, eliminating traditional intermediaries like banks and offering potentially lower interest rates.

- Personal Finance Management: These apps help users track their expenses, create budgets, set financial goals, and gain insights into their financial health.

- Cryptocurrency and Blockchain: Some fintech apps focus on cryptocurrencies like Bitcoin and Ethereum, offering trading, investing, and wallet services. Blockchain technology is also employed for secure and transparent transactions.

- Insurance and Insurtech: Fintech apps offer insurance solutions, simplifying purchasing policies, filing claims, and managing coverage.

- Remittances: Users can send money to family and friends abroad through remittance fintech apps, often cheaper than traditional methods.

- Digital Wallets: These apps store payment information and allow users to make contactless payments using mobile devices.

- Credit Scoring and Underwriting: Fintech apps leverage data analytics and alternative data sources to assess creditworthiness and provide loans to individuals or businesses.

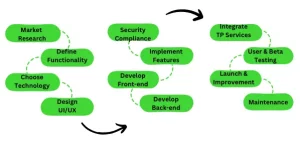

How to build a Fintech App: Step by Step Guide

- Idea and Market Research:

-

- Identify a specific problem or need within the financial industry that your app can address.

- Conduct thorough market research to understand your target audience, competitors, and potential demand.

- Define Features and Functionalities:

-

- List your fintech app’s core features and functionalities, such as mobile banking, investment tracking, or peer-to-peer payments.

- Prioritise features based on their importance to users and your app’s value proposition.

- Choose the Technology Stack:

-

- Select the appropriate programming languages, frameworks, and frontend and backend development tools.

- Consider security, scalability, and compatibility when making technology decisions.

- Design User Interfaces (UI/UX):

-

- Create user-friendly and visually appealing UI/UX designs.

- Design intuitive navigation, clear call-to-action buttons, and user-friendly forms for data entry.

- Develop Backend Infrastructure:

-

- Set up the backend servers, databases, and APIs to handle data storage, processing, and communication.

- Implement robust security measures, including encryption, authentication, and data validation.

- Frontend Development:

-

- Develop the user interfaces based on the approved designs.

- Ensure responsiveness across different devices and screen sizes.

- Implement Core Features:

-

- Develop the primary features of your app, such as account registration, login, dashboard, and basic functionality.

- Test each feature thoroughly to ensure they work as intended.

- Security and Compliance:

-

- Incorporate robust security measures to protect user data and financial transactions.

- Ensure compliance with industry regulations and data protection standards.

- Integrate Third-Party Services:

-

- Integrate payment gateways, APIs for financial data aggregation, identity verification services, and other third-party services your app requires.

- User Testing:

-

- Conduct extensive user testing to identify bugs, usability issues, and areas for improvement.

- Gather feedback from real users and iterate on the app based on their input.

- Beta Testing and Quality Assurance:

-

- Launch a beta version of your app to a limited user group to gather more feedback and identify any remaining issues.

- Perform comprehensive quality assurance testing to ensure the app’s stability, security, and performance.

- Launch and Marketing:

-

- Once all issues are resolved, launch your fintech app on app stores (iOS, Android) and web platforms.

- Develop a marketing strategy to promote your app and attract users.

- Continuous Improvement:

-

- Monitor user engagement and feedback post-launch to identify areas for further enhancement.

- Regularly update your app with new features, improvements, and security updates.

- Customer Support and Maintenance:

-

- Offer customer support to address user inquiries and issues promptly.

- Provide ongoing maintenance to ensure your app remains secure and up-to-date.

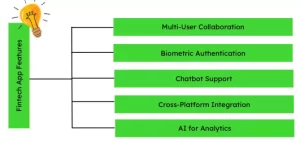

Fintech App Features

Some important fintech app features that you need to know:

-

Multi-user Collaboration

To complete a financial transaction, you need an intervention by more than one party. You can understand the scenario with example, one person can transfer funds to another or a bank lends money to its customer.

To enable multiple users to use the app, it is important to have a multi-user collaboration. They can complete deals, tasks, and transactions through one app only instead of using two different apps.

For example:

KhataBook is a digital ledger app that enables small businesses, shop owners, and merchants to manage their financial transactions, credits, and debts collaboratively. It simplifies the process of tracking accounts, expenses, and payments between businesses and their customers.

The app allows multiple users, including business owners and customers, to collaborate on financial transactions. Businesses can share transaction updates with their customers and vice versa, facilitating transparency and reducing the complexities of manual bookkeeping.

KhataBook’s multi-user collaboration features empower small businesses and merchants to maintain accurate financial records, strengthen customer relationships, and improve transparency in financial dealings.

The app addresses the challenges of manual bookkeeping, reduces misunderstandings between businesses and customers, and aids in maintaining clear financial histories.

-

Biometric Authentication

Biometric authentication is about using a person’s unique characteristics like facial features, fingerprints, or voice for recognition. Users can deploy biometric authentication in place of password or login access.

It enhances security because creating a duplicate biometric component is not easy.

Finances involve worries. In one example, Paytm is one fintech brand that offers a wide range of financial services. Paytm incorporates biometric authentication methods, such as fingerprint and facial recognition, to enhance security and streamline user access to their accounts.

By enabling biometric authentication, Paytm enhances user security, reduces reliance on traditional passwords, and provides a seamless and secure experience for financial transactions.

Biometric authentication has become an integral part of Paytm’s user experience, offering a quick, convenient, and secure way for users to access their accounts and carry out financial activities.

-

Chatbot Support

Chatbot Support enables fintech apps to keep in touch with the customers and resolve their queries fast when need be.

Customers can also approach the financial apps for any glitches.

Kotak 811 is a digital banking platform by Kotak Mahindra Bank that offers a range of banking services through a mobile app, including account opening, payments, fund transfers, and more.

Kotak 811 app integrates a chatbot feature known as “Keya.” Keya serves as a virtual assistant that provides customers with real-time assistance, answers queries and performs various banking tasks.

Keya chatbot enhances customer engagement, offers instant support, and provides a self-service option for everyday banking tasks. The convenient user experience, enabling users to interact with the bank’s services through natural language conversations.

-

Cross Platform Integration

Cross platform integration allows users to connect with other apps or platforms for better functionality. The integration makes life easy for users.

PhonePe is known for its seamless cross-platform integration, allowing users to access and use its services across various platforms and applications.

PhonePe’s cross-platform integration provides users with a unified experience, enabling them to conduct financial transactions seamlessly across various services.

The ability to use PhonePe’s services across different apps and platforms has contributed to its widespread adoption and popularity as a digital payment solution in India.

-

AI for Analytics

AI enabled fintech apps give access to data analysis and market visualisation. The apps can generate charts, graphs, and other data visualisation tools enabling users to identify their financial health.

Zerodha is one of India’s largest stock brokerage platforms, offering trading and investment services in stocks, commodities, derivatives, and more.

These AI-powered analytics tools give users insights and data-driven trading and investment decision recommendations.

By integrating AI-driven analytics, Zerodha empowers traders and investors with data-driven insights that can aid in making informed decisions and managing risks. The app allows users to harness the power of technology to enhance their investment strategies.

Challenges faced in Fintech App Development

Fintech app development comes with its challenges due to the complex nature of financial services and the need for stringent security measures. Here are some detailed challenges faced in fintech app development:

- Regulatory Compliance:

-

- Fintech apps often deal with sensitive financial data, making compliance with financial regulations (such as KYC and AML) crucial.

- Navigating different regulations across various jurisdictions can be complex and time-consuming.

- Security and Data Privacy:

-

- Fintech apps handle confidential user information and financial transactions, making security paramount.

- Encryption, secure authentication, and data protection measures are essential to prevent breaches.

- User Trust and Adoption:

-

- Gaining users’ trust is crucial in fintech. Convincing users to trust the app with their financial data can be challenging, particularly for newer entrants.

- User adoption can be slow if potential users are wary of security risks or unfamiliar with the app’s benefits.

- Payment Gateway Integration:

-

- Integrating payment gateways securely and seamlessly is critical for enabling transactions.

- Ensuring compatibility with various payment methods and platforms adds complexity.

- Technological Complexity:

-

- Fintech apps often involve intricate financial calculations, real-time data processing, and integration with external APIs.

- Developing and maintaining such technical intricacies can be challenging.

- Scalability:

-

- As fintech apps gain users, they need to handle increased traffic and transactions without performance degradation.

- Ensuring the app remains responsive and efficient under high loads is a constant challenge.

- Data Accuracy and Integrity:

-

- Fintech apps must ensure data accuracy, especially for financial calculations, to avoid errors impacting users’ finances.

- User Experience (UX):

-

- Providing a seamless and user-friendly experience is crucial in fintech. Complicated user flows or unclear instructions can lead to frustration and abandonment.

- Emerging Technologies:

-

- Staying up-to-date with evolving technologies like blockchain, AI, and biometrics is essential for staying competitive in fintech.

- Licensing and Partnerships:

-

- Obtaining necessary licences for financial services and establishing partnerships with banks or payment processors can be time-consuming.

- Market Competition:

-

- The fintech industry is highly competitive, with established players and startups vying for users’ attention. Standing out requires innovative features and strong value propositions.

- Cross-Border Transactions:

-

- For apps facilitating cross-border transactions, dealing with currency conversions, international regulations, and compliance adds complexity.

Also Read : Mobile App Development Cost in 2023

Conclusion

In the world of fintech app development, Noboru stands as your ideal partner. Our expertise crafts user-friendly apps that blend finance and technology seamlessly. From biometric security to AI analytics, we’ve covered every angle for your app’s success.

Elevate payments, simplify investments, or manage finances – we’re here to make your app shine. Contact us at hello[at]noboruworld.com to embark on this journey. Your idea, our skill – together, we’ll sail to fintech excellence.

You can also prefer Fintech App Development: A Step-by-Step Guide for 2024, for more detailed information.

FAQ’s

What is the cost of fintech app development?

| Type of Fintech App | Price |

| Basic Fintech App | $20,000-$50,000 |

| Intermediate Fintech App | $50,000-$150,000 |

| Advanced Fintech App | $150,000-$500,000 |

How do fintech apps ensure security?

Fintech apps employ various security measures, including encryption, multi-factor authentication, and compliance with industry regulations to protect user data and transactions.

Can I integrate third-party services into my fintech app?

Many fintech apps integrate payment gateways, APIs for financial data aggregation, and other third-party services to enhance functionality and user experience.

What challenges do fintech app developers face?

Challenges include regulatory compliance, security concerns, cross-platform compatibility, ensuring a smooth user experience, and staying updated with evolving technologies.

How do I choose a fintech app development company?

Look for a company with experience in fintech, a strong portfolio, expertise in security, and a user-centred approach. Companies like Noboru offer these qualities.

What benefits can a custom fintech app provide over using existing services?

Custom fintech apps offer tailored solutions, enhanced security, and unique features that cater to your business needs, setting you apart from off-the-shelf solutions.